THIRD-PARTY IDENTIFIERS ARE GOING AWAY.

WHAT’S THE IMPACT ON FINANCIAL MARKETERS?

THIRD-PARTY IDENTIFIERS ARE GOING AWAY. WHAT’S THE IMPACT ON FINANCIAL MARKETERS?

THIRD-PARTY IDENTIFIERS ARE GOING AWAY. WHAT’S THE IMPACT ON RETAIL MARKETERS?

Our survey results show financial services marketers feel anxious about what’s at stake.

THIRD-PARTY IDENTIFIERS ARE GOING AWAY.

WHAT’S THE IMPACT ON FINANCIAL MARKETERS?

Our survey results show financial services marketers feel anxious about what’s at stake.

How do financial services marketers prepare now so they don’t fall behind?

We conducted a survey to find out.

Why does 3PID deprecation matter for financial services marketers?

Why does 3PID deprecation matter for financial services marketers?

Financial services marketers rely heavily on cookie data, mobile ad identifiers (MAIDs) and other identifiers to serve personalized ads, which help their brands stand out in a crowded market. When 3PIDs go away, marketers will have an uphill battle reaching their customers at all, and will struggle even further to personalize their content to the right people.

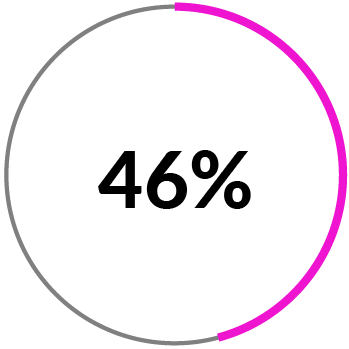

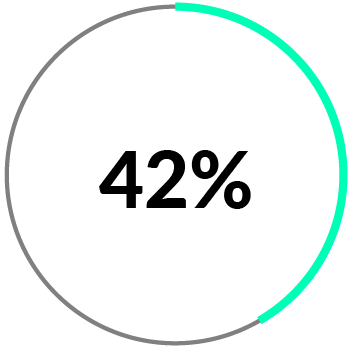

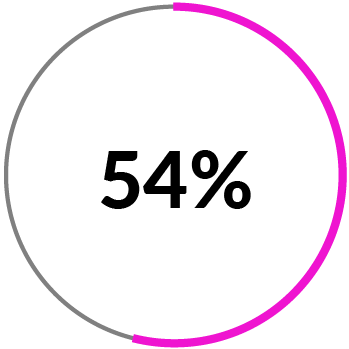

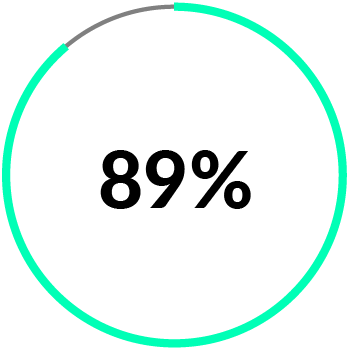

of financial services marketers think these changes will impact their digital advertising efforts significantly

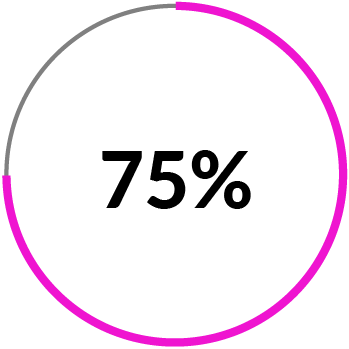

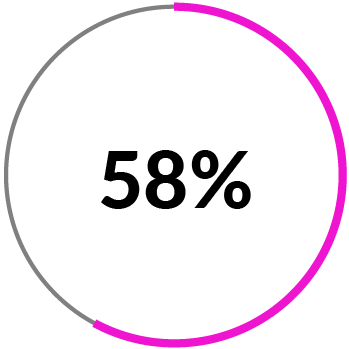

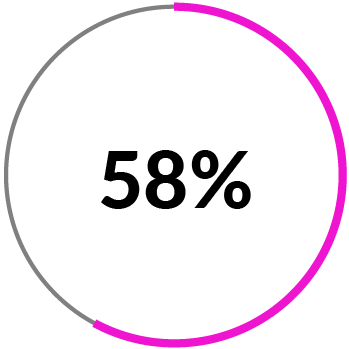

of financial services marketers think digital advertising will take a step backwards in personalizing and proving marketing effectiveness

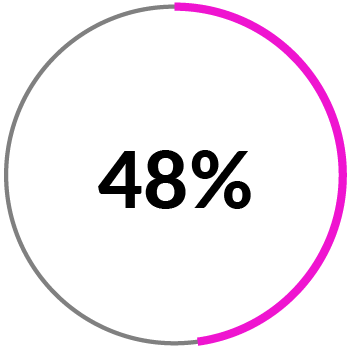

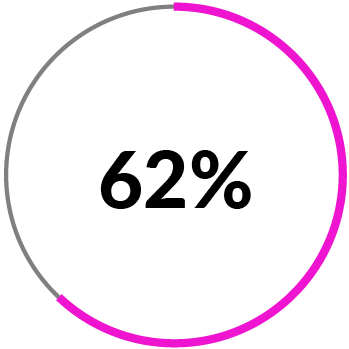

of financial services marketers are “very reliant” on 3PCs with an additional 30% that are “moderately reliant”

Why is this important now?

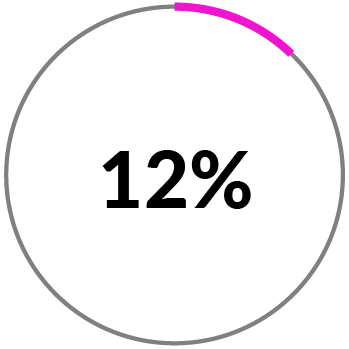

of financial services marketers agree 3PID deprecation will have at least the same (or greater) impact as GDPR and CCPA

of financial services marketers feel “somewhat” prepared for the shift

Here’s what’s on the table:

Identity is much more than just knowing how many people you can reach online. It’s about knowing who at an individual level you’re actually talking to—while keeping your potential customers’ data private.

Personalization

Are we slipping back to more contextual, segment-based (and less effective) advertising?

Measurement

Whom have you been messaging? And which of these people became a new account or accessed additional products (cross-sell)? You need the hard numbers to prove your ROIs and optimize spend.

How are financial services marketers preparing now?

Building a private ID graph

Trying to build your own database that houses all known identifiers that correlate with individual customers may seem like the right idea—but most financial services institutions don’t have the actual reach or scale to do this completely on their own.

Building a CDP

CDPs are important in the post-3PID world, but Forrester’s Joe Stanhope says, “Marketers must proceed with caution and seek CDPs that can deliver stronger capabilities than the tools they already have.”

Reverting to contextual targeting

Although it’s the easiest route, segment-based advertising means less relevant messaging. Financial services institutions would lose the individual-level personalization that many customers expect today.

Using first-party data strategies

This is the big opportunity for financial services marketers. With third-party data harder to acquire and to use effectively, financial institutions do have the first-party data needed to execute relevant marketing across channels.

Using data clean rooms

Another interesting opportunity, cross-vendor clean room solutions give financial services brands access to highly unique ad data without self-serving vendor restrictions that impact activation and measurement.

Financial services recommendations

Diversify data sources and maximize how you collect and activate your first-party data.

Because data from 3PIDs will be harder to acquire and use effectively in the future, financial services marketers need to increase their first-party customer interactions and the data they collect from them. Financial institutions have a lot of great data in their owned channels, but are missing what’s happening outside their walls.

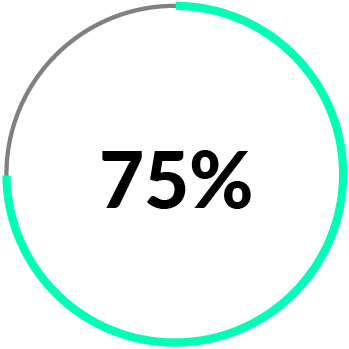

of customers are more willing to do business with a financial institution that offers personalized experiences

An easy place to start? Transactional data—intent data signals that happened through transactions, online behaviors, places they visit, etc.

If you want to continue to deliver individual-focused ads across the open web without 3PIDs, the best option is to integrate with first-party data from website publishers.

Many publishers collect data from their users in exchange for content. Scaled and linked to a strong identity graph, this data can be used to identify customers and personalize ads after 3PIDs are gone.

Don’t just rely on one or two flimsy identifiers. Knowing and understanding who you’re messaging in the digital space should be based on multiple identifiers—think up to eight or nine ways to verify a person’s identity.

- Email address

- IP address

- Login data

- Phone number

- Social media ID or handle

- Device ID

- First-party cookies

- Postal address

- Transaction data—online and offline

Financial institutions may not have every single identifier for every person, but digital identity should be built on multiple identifying traits to ensure accuracy, relevance and measurement.

Be prepared and don’t miss digital conversions with your customers.

Get the full research: Preparing for a world without third-party identifiers

First Name*

Last Name*

Company*

Country*

Email Address*